There are some stories in life that truly move and inspire you. To be an inspiring storyteller, is a gift.

However, all talent must be continually used and worked on if you are to turn talent into something great.

That is when you become a professional. What is a professional? Someone who is paid to do a job.

God gives talent. Work turns talent into genius. Anna Pavlova, Russian Prima Ballerina (1882-1931)

I’ll share with you over time some stories real and fictional that have inspired me on this blog such as Oprah and Jay Leno.

Just to name a few stories, you know off the top of my head, the following:

- Hearing about strangers helping strangers.

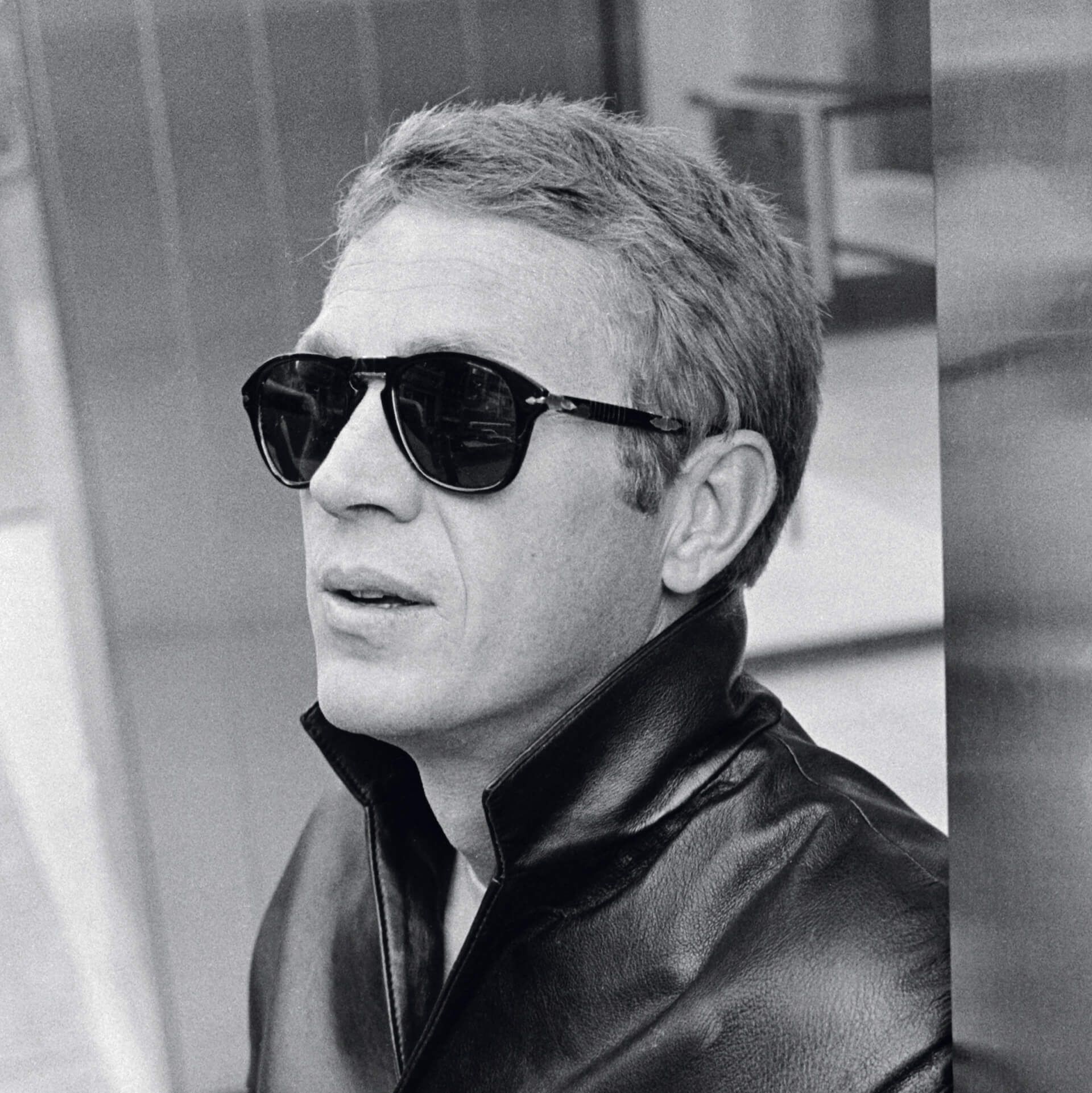

- People paying it forward by becoming part of an organization as Denzel Washington and Steve McQueen did with their efforts with the Boys and Girls Club.

- *Just FYI: The actor Steve McQueen grew up poor. The Boys and Girls Club gave him a clean and safe place to be in his youth. He paid it forward after he become a famous actor by asking movie studios to give him thousands of white t-shirts, socks, and personal hygiene products as part of his compensation package for starring in their films. He secretly turned around and donated all this material to the Boys and Girls Club to give out to the young men there. Just melts your heart doesn’t it.

- How the Teenage Mutant Ninja Turtles always looked out for the little guy.

- The friendship between Shaggy and Scooby-Doo. Those two they just warm my heart.

Some of my favorite singers that have turned their talent into success are Whitney Houston, Pat Benatar and Toni Braxton.

One of the things I remember Ms. Braxton saying, “music is not about you just saying what you think, but how you make people feel.” Her music and voice have always made me feel good.

Seeing her up on that stage performing recently at the American Music Awards, reminded me of all the reasons I liked her; she has a gift for making you feel good with the words she sings that transcends whatever hard times you are going through in that moment. She makes you feel happy.

And speaking of people that inspire you with their words, I would like to introduce you today to someone who has not only done that for me, but for millions of people around the world through his writing on personal finance. The one and only Mr. JD Roth.

He has turned his passion and talent into success as a successful writer and blogger. I had the pleasure of meeting him in person.

He was kind enough to agree to this interview on Greenbacks Magnet (GBM).

Here at GBM we are all about rejecting buying brand new fresh off the factory floor made cars in order to become Financially Independent (FI).

We pull back the curtains and blow the top off the math, and not the Mercedes, behind how not buying new cars can make you rich.

GBM is the place where we like to get down and dirty into the math behind building wealth, but we keep the jokes clean. Our jokes here are like a Hallmark card, GBM cares enough to send the very best! Even my tweets are called Lipstick Confessions!!! haha 💋Smooches

Below is just a taste of what GBM has to offer. This blog ages like fine wine; it only gets better with time. No topic is off limits!!! Not even French Fries!!

I’m like Space Ghost Coast to Coast. Booking celebrity guests for my audiences reading and fiscally literate pleasure.

Fun Fact: The original pilot of Space Ghost C2C was produced in a closet, and the guest was Denzel Washington (second mention in this post cause Denzel is just everywhere). It was green-lit as a series on the Cartoon Network in 1994 and went on to huge success.

Therefore, if you are looking to start a podcast, let this be inspiration to know it is okay to start it on a shoestring budget and in your closet.

Let’s get down to the interview.

Topic du jour: The tortoise wins the get rich race every time. Who is the man behind the tortoise shell?

Subject: Men who talk money. How to Get Rich Slow?

GRS JD Roth: YES, I would be happy to do your interview.

Ladies and Gentlemen, please put your hands together for Mister JD Roth!!! The founder of Get Rich Slowly.

ALLOW ME TO INTRODUCE MYSELF

GBM Miriam: It was great meeting JD Roth of Get Rich Slowly at FinCon 18 in Orlando. I had seen his picture on the blog-sphere so many times that I knew who he was on sight. I tried to keep a calm and cool composure, but on the inside I was screaming, “IT’S JD ROTH!!!!!” Over and over in my head.

Imagine my surprise when I got to ride shotgun with him on our way to a restaurant for a fellow bloggers birthday.

Here I am a total stranger and he was as cool as a cucumber. Totally down-to-earth and fun too. Check out one of his tweets. Hilarious!!!

You can check out more of this story on my post about my very first FinCon called FinCon The Recap from your Friendly Neighborhood Greenbacks Magnet Part I and Part II.

We are in the car with Liz of Chief Mom Officer, Military Dollar, and Erin of Reaching for FI. In a car full of women, he was totally cool driving while listening to Taylor Swift. Yes, I found out that JD is a T. Swift fan. I am too. It’s like john jacob jingleheimer schmidt up in here!!!

Here is proof here!! I just so happen to think Taylor Swift is pretty awesome too! 😉 Great minds think alike. I literally just posted tweets on Taylor Swift and Lizzo last week. 😂👍

Let’s dive into the interview.

MEET JD ROTH

This is how it feels to meet JD.

Yes, he was just that friendly and down-to-earth.

This is how I felt getting to interview JD. Over the moon and on top of the world. After three years of blogging, I made it. I’m still here. Anything is possible if you work hard enough for it. 😉So Grateful.

JD STARTS A BLOG ABOUT GETTING RICH

1. What prompted you to start a blog about money? How much makes you feel rich? Would you say $500k, $1M, $2M, or more?

I started Get Rich Slowly for three reasons. First, I wanted to document my own journey out of debt. Second, I thought maybe I could help other people learn to manage money as I improved my own financial skills. Finally, I hoped maybe I could make a few hundred bucks per month to supplement my income.

I had NO idea that starting Get Rich Slowly would change the trajectory of my life, financial and otherwise. It wasn’t even something I could have conceived at the time. Yet it changed everything.

How much makes me feel rich? That’s a great question. It doesn’t take much. I grew up poor. My family lived in a run-down trailer house in rural Oregon. My father was often out of work. Sometimes we had to take assistance from our church in order to get by. Today, I have far more money than my parents ever did. I feel very rich. But I don’t know what dollar amount leads to that…

GBM Miriam: Well ok. Thank you for your honesty. It is always appreciated. I fell into learning about money by accident. I was at my boyfriend’s place when I saw a Kiplinger magazine lying around. I just so happened to pick it up…

2. Any favorite finance books? How come?

I’ve read and enjoyed many finance books, but my favorite books about money usually aren’t actually books about money. What I mean is that often the books that I believe will most help people with their finances aren’t financial books. They’re only tangentially related to finances.

For instance, I think The Seven Habits of Highly Successful People is probably one of the most helpful book anyone can read if they’re struggling to improve their finances. The ideas and philosophy it conveys are so valuable in developing a successful financial mindset.

GBM Miriam: One of my top favorites is The Millionaire Next Door. That and the one you named are some good reading. 👍

3. What are you reading right now? What’s on your night stand?

Haha. I always have several books going at once. Right now, I’m reading:

* Wake Up and Live! by Dorothea Brande

* House of Suns by Alistair Reynolds

* Y: The Last Man by Brian K. Vaughan

* Deep Work by Cal Newport

This “many books at once” habit kind of goes against the whole Deep Work philosophy…

4. One thing people may not know about you?

When I left for college in 1987, I thought I was going to be a religion major. My aim was to get a religion degree, then become a Christian missionary. I thought I’d ultimately end up as a church pastor.

GBM Miriam: I did see you mention something about that on your blog. I put a link to that story in your response for readers to be transported there faster than Marty hitting 88 mph by clicking on college in 1987.

5. What’s in your wallet? How did you start building wealth?

These two questions don’t seem related.

I carry a minimalist wallet: https://www.tombihn.com/products/minimalist-wallets?variant=13762302378047

It contains my debit card, my business credit card, my personal credit card, my Apple card, maybe $40 cash, and my insurance info (health and vehicle). That’s it.

I started building wealth through a two-pronged attack. First, I reduced how much I was spending. Second, I worked to build my income. Basically, I did my best to work both sides of the wealth equation (income and spending) in an attempt to grow my saving rate as high as possible.

GBM Miriam: Awesome. I started by saving $1 a day. Then gradually started increasing my savings and investing rates from 5% to over 40% of my income over like 10 years. I cut out buying crap and clothes to bank that money for my future baby!!

Well said. So that’s what I did. Unlike that episode of King Meets Queens, when Carrie buys thousands of dollars worth of expensive clothes, keeps the tags on them to return them for a refund (get this because she could afford them *ahem* $2,000 Chanel suits) and said this to her husband…

If this sounds like you, please stop reading THIS and go read the Get Rich Slowly archives right now! If you want to get rich, cut the excuses and get fiscally educated!!!

If you are truly fiscally clumsy, then try the lazy method of investing. I would use Swensen’s model that he crafted for Yale University. With over $27 billion dollars under management, the Yale endowment is the second largest college endowment in the world (Harvard is #1). Just watch the video. Now you and Rory Gilmore will have something in common.

And if this is too much, just park your investments into a total stock market fund like the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) or Vanguard Total Stock Market ETF (VTI).

BONUS ROUND

Bonus Questions (pick any of the questions from the top or below that you want to answer)

6. Any life or money lessons from a favorite movie or TV show you would like to share?

I’m partial to Mr. Roger’s philosophy of loving others and encouraging others to love. He believed in accepting people for who they were, regardless of who they were. I subscribe to that ideal too.

GBM Miriam: Good stuff. I ❤ Mr. Rogers I wanted to take a ride on that train soooo bad! It looked like so much fun.

7. If you found a lottery ticket that ends up winning $1.5 million. What would you do?

I would buy new cars for me and my girlfriend. I’d get her a Tesla Model 3. I’d buy myself a Mini Cooper — the electric model, if it ever gets released. I’d stick the rest of the money in the bank.

GBM Miriam: A mini Cooper eh? I can dig it.

But that Tesla looks sexy.

And love those falcon wing doors.

8. Who is your favorite X-men, Justice League, Avengers or comic book character? Why?

I’ve always been partial to nerds from the Marvel universe, characters like Cyclops from the X-Men or Mr. Fantastic from the Fantastic Four.

GBM Miriam: You are probably wondering why I asked this question. Beside being a huge cartoon and Mavel fan, I actually named this blog after a Marvel comic book character; Magneto. 😉

Just FYI: We skipped a few numbers and moved on to question 11.

11. If both a taxi and a limo were priced the exact same, which one would you choose?

Neither. I would probably walk, if I could.

GBM Miriam: Yeah, that’s me. I love to walk. I’m like Elizabeth Bennett in Jane Austen’s Pride and Prejudice.

12. What song or songs best describes your work ethic?

“Don’t Worry, Be Happy” 🙂

13. What would you do if you just inherited a pizzeria from your uncle?

I would sell it, if it were profitable. Hell, I’d sell it even if it weren’t profitable. That sounds like too much work!

GBM Miriam: You may be right. I know it’s just a cartoon but they worked the crap out of Doyle in that pizza place in Galaxy High!! 🤣

14. What was your best MacGyver moment?

This question is so NOT me. I’m not a MacGyver type. That said, my best MacGyver moment was probably installing a new tape deck in the 1993 Toyota pickup I bought last January. Admittedly, I had instructions for this project, but it was still pretty MacGyver-y for me. Now I can listen to cassette tapes as my dog and I cruise around Portland. 😉

15. If I gave you $40,000 to start a business, what would you start?

I know the answer to this! I’d start a blog. In fact, I’ve spent a similar amount to launch blogs in the past — and they’ve become businesses.

GBM Miriam: Why am I not surprised. 😆 I love blogging too.

How I feel about blogging: “Tonight, darling, we are going to right a lot of wrongs. And we are going to wrong some rights. The first shall be last; the last shall be first; the meek shall do some earth-inheriting.” -Margo Roth Spiegelman, Paper Towns by John Green

16. If you had $2,000, how would you double it in 24 hours?

Hm. I’m not sure. There’s no reliable way to do this, of course. My inclination would be to pick a game of pure chance, such as roulette, then to make a single bet that would either double the money or lose it in one go. Using that roulette example, if I bet all $2000 on, say, even numbers or odd numbers, I’d have about a 48% chance of doubling my money and a 52% chance of losing it all.

Really, though, there’s no sure way to do this.

GBM Miriam: That’s JD. He always gives it t you straight and keeps it 💯just how we like it.

For example, he just put this out there for our fiscal viewing. Check out his post on Our first annual family meeting. Bringing people and finances together. As a financial blogger, that just melts my heart ❤right there.

THE END

GBM Miriam: Thank you JD!!! It was an absolute dream come true and a pleasure to have you stop by Greenbacks Magnet.

It was my honor to be your host this evening. See you at FinCon 2020. The year of perfect vision!!! Until we meet again!!! I bid you farewell.

Want more fiscal nuggets of wisdom, from the JD Roth?

Find him on his website and connect with him on Twitter at @getrichslowly.