“All the world is made of faith, and trust, and pixie dust.”

― J.M. Barrie, Peter Pan

Trust is a five-letter word. A word that is small in size, but whose meaning is of monumental importance.

Today on Greenbacks Magnet we are spilling the tea and reading the tea leaves on the topic of personal finance.

Somewhat like Jalen and Jacoby do on their podcast.

This is a no-holds barred conversation about getting your fiscal house in order.

If I had a podcast right now, I have several friends or family members that could be my partner on this magic carpet ride. Aladdin had Princess Jasmine. Jordan had Scottie Pippen. Keenan had Kel. Barack has Michelle. Oprah has Gayle. Key had Peele. Batman has Robin. Kermit the Frog has Miss Piggy. Jalen has Jacoby.

Having a partner just makes things more fun.

I ask my significant other all the time, “Are you gonna back me up?! Are you gonna be the pip to my Gladys?!” I need people with good character that I can trust around me.

It’s like my man Shakespeare says, “Love all, trust a few, do wrong to none.” ― William Shakespeare, All’s Well That Ends Well

Trusting people with your money comes with huge financial risks! And I notice it is more risk than reward. You have to be on top of things when it comes to your money.

So today, I am going to give you some real stories of private conversations I have been in, eavesdropped on, and stood witness to in hopes it might help you more easily navigate these hostile fiscal waters out here in these mean streets.

I’m doing it Jalen Rose and David Jacoby style for those of you ESPN fans out there, you know what I’m talking about.

I want you to trust my advice, and me but I also want you to verify it.

Let’s get started and dive right in.

In the spirit of Jalen and Jacoby:

Got to give the people…

Give the people what?

What they want!

What do they want?

Current events! They want you to spit that hot fire!

And in this blogs case FIRE is Financial Independence, Retire Early!

TRUST, BUT VERIFY

That is a famous quote uttered by former President Ronald Reagan during the Cold War.

He was a former Hollywood actor turned politician, which was unheard of at the time in 1981. My how times have changed.

Reagan also gave us Reaganomics, also known as Voodoo Economics, it works as crazy as it sounds. Voodoo (magic) is French in origin and hails from Louisiana around the 1700’s, which is before the Louisiana Purchase between the United States and France, negotiated by President Thomas Jefferson and Napoleon in 1803.

Therefore, the term Voodoo Economics simply means magic economics or finances (magic money).

There goes that Peter Pan quote I put at the top circling back to us as magic money is like pixie dust! It just doesn’t exist! In my mind, this is like creating money or great finances out of thin air.

It’s kind of how 50 Cent said he owed $8 million worth of Bitcoin when he owed nothing and created $8 million of wealth for himself in the eyes of his followers on Instagram because we are all just, and I roll my eyes as I type this, “living for the Gram.” I discuss fifty and the Gram on this post.

According to Psychologytoday.com, Reaganomics is this in that “the simple answer: when the outcome is essential and matters more than the relationship, use “trust, but verify.” When the relationship matters more than any single outcome, don’t use it.” Basically, if you are unsure of how to proceed in making a decision where the outcome can be life-changing, then do your research to uncover the facts before saying yes.

In my opinion, that means reviewing credit reports before walking down the aisle.

Why should I commit to someone with four felonies, two bankruptcies, a property lien and $50,000 of back taxes owed to the IRS without knowing what I am getting myself into. You would be surprised what you uncover with a simple credit report.

A woman has a right to say no or change her mind about marriage all the way until the time she is in front of the minister. It’s cool to trust your partner when they say they paid off that Neiman Marcus credit card, but request that copy of the credit report baby to verify.

WHAT IS REAGANOMICS?

Reaganomics, or Reaganism, refers to the economic policies promoted by U.S. President Ronald Reagan during the 1980s.

The economic policies of the former US president Ronald Reagan, associated especially with the reduction of taxes and the promotion of unrestricted free-market activity. “the claim that cutting taxes generates more revenue was a key element of Reaganomics”

When looking up Voodoo Economics this pops up in the search: an economic policy perceived as being unrealistic and ill-advised, in particular a policy of maintaining or increasing levels of public spending while reducing taxation. “as governor, he put into practice the same voodoo economics that he would later impose on the country as president”

I will give it to you in layman’s terms, give more to the rich and their gains of money and benefits should also find it’s way down to everyone else.

It’s the reverse of Robinhood’s theory of taking from the rich and giving to the poor, by instead giving to the rich. There you have it. I just gave you the premise of Trickle-down Economics.

WHAT IS TRICKLE-DOWN ECONOMICS?

Great question. Trickle-down economics, also called trickle-down theory, refers to the economic proposition that taxes on businesses and the wealthy in society should be reduced as a means to stimulate business investment in the short term and benefit society at large in the long term.

According to thebalance.com writer Kimberly Amadeo, Trickle–down economics is a theory that claims benefits for the wealthy trickle down to everyone else. These benefits are tax cuts on businesses, high-income earners, capital gains, and dividends. … All of this expansion will trickle down to workers.

I don’t know about that.

When I look to my left on the West Coast, I see massive homelessness.

When I look to my right on the East Coast, I see wage stagnation.

Taxes got cut, but people are in even more debt. When the top 10% of the richest American households own 84% of the stock market wealth in the country something is terribly askew.

I call gentle bullshit on all this record stock market gains that is causing the country to grow wealth for all.

It seems more that instead of lifting all boats to prosperity for 99% of the population, stocks are lifting a few yachts of the 1%.

In the illustrious words of Sheldon Cooper, pardon me, I mean Dr. Cooper, this is a bunch of hokum. I mean the term even has the word trick in it. Hello?

WHEN IN ROME, TAKE OUT MORE DEBT

I have seen stuff you would not believe people have done when it comes to their money.

I saw a couple of government workers deciding to take on an $800,000 mortgage. Don’t ask me why. After 30 years of payments, they will have paid $1.6 million for a pile of bricks they are never at because they are always at work. Then the husband loses his job and they lose the house!

If you do not have $1.6 million in retirement or other assets, then you cannot afford or should not buy a home for three-quarters of a million.

Since, many college students see their friends take out loans to fund spring break trips they feel they are entitled to do it too! I actually knew someone who got a boob job and paid off a car with a student loan refund.

I hear tons of people say they are never going to retire, can’t afford college, and will work forever but no one wants to downsize their $400,000 mortgage. If they want it, they get it. How you ask? Do what the neighbors did and take out a HELOC.

A FLY ON THE FISCAL WALL

I’m about to spill that tea so don’t blink or you might miss it!

Overheard around an office watercooler.

“I owe $100,000 in back property taxes to the IRS.”

Overheard at the nail salon.

“I bought a $700 Gucci belt.”

Heard it from a friend.

“My daughter wants a pair of Gucci boots.”

Come on now. I have said it before. The only teenager that deserves a pair of Gucci boots is on stage with her two friends Kelly and Michelle.

A grandmother recounting her money woes to me.

“I am in $25,000 worth of credit card debt. I am on a fixed income. My granddaughter was supposed to use my credit card for a one-time charge to pay her auto insurance when she got a new car and then I found out she never stopped it and I paid for the whole year! When I asked her for the money back she said she didn’t have it and then told me about all the bills she has.”

A male-exotic dancer told me, “I strip because I don’t make enough at my job to live on that.”

The guy who can’t pay his child support who owns a Range Rover and house is constantly in danger of foreclosure.

A beauty salon owner who confided in me. Her child support payment is $25 a month and the father keeps quitting his job so he don’t have to pay it! At the tender age of 25, she also decided to lease a beauty shop and buy a home. She said, “It’s like paying two mortgages.”

Another friend.

“I would rather struggle today and get my forever home, than buy a starter home and have a smaller home and have to move.”

A cousin.

“I can’t make too much or they will take me off Section 8 housing.”

Just FYI, many safety net programs do not allow you to make too much or have too much in savings or assets. If you have more than $2,000 in checking, you could lose all income assistance benefits and NEVER be able to get back on. Essentially, keeping the poor trapped in a cycle of poverty.

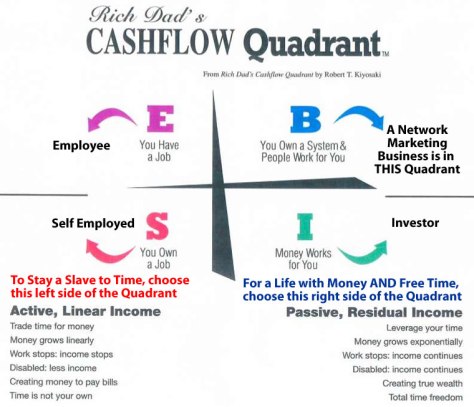

CHANGE THE MONEY GAME

There is a saying. Control your money; control your life. When you know how money works life is easy. When you don’t, life is hard.

I read every book I can get my hands on about finance. I have learned about taxes, insurance, stocks, real estate, and entrepreneurship.

Here are a couple books I have read that changed my money mindset.

Some things I have done to build wealth and start saving over $13,000 a year.

I stopped getting personal loans. It took me years to pay off a $20,000 personal loan. I took that $333 monthly payments and started saving money.

I once had a $448.65 car payment. I paid off the car and started investing that money.

I started studying the stock market.

I cut out buying clothes and all shopping and stared saving over $8,000 a year. I canceled subscriptions. Maybe Jillian Michaels may want to do the same as on her Instagram, cause you know we are all “living for the Gram,” she stated she would like to figure out how “like to get my American Express bill down.”

I only spend on things I love and I cut spending mercilessly on the things I don’t.

I transferred over $84,000 out of multiple stock funds and placed my bet on one 500 index fund.

I write money milestones.

The goal is to be a 401(k) millionaire.

By investing over 25% of my income into things like the VFINX, VFIAX, or VTSAX, I can make this dream a reality.

Milestone number one was $100,000 in Mr. Market. I hit that marker and kept on climbing.

The money starts accumulating faster like a freaking avalanche once you have that first $100k. The next stop was $200,000.

Then I started making my way to a quarter million.

I estimated that once you hit $250,000, then you can get to millionaire status in 14.5 to 23.5 years with a 6% or above interest rate. And that is without adding another dime.

Once you get to one-quarter of a million, the other three-quarters are not too far behind.

If you could invest $20,000 a year including employer match, you could be a millionaire in 10 years with a 10% return with a principal investment start of $250,000.

That first $100,000 is your capital to a better future. It plants the seed money from which the rest of the harvest will grow.

DROPPING DIMES LIKE SCROOGE MCDUCK AND OTHER MONEY HINTS

Dropping dimes used to mean putting a dime in a payphone to connect with someone.

Now it is used more figuratively than literally as in giving some knowledge in this case.

The reason I invest most of my money in index funds is this piece of advice from Warren Buffet.

He instructed the trustee in charge of his estate to invest 90 percent of his money into the S&P 500 for his wife after he dies.

Warren Buffet is worth $81 billion. Most of his wealth came after the age of 50. Buffet gained 99% of his wealth after 50. That 1% of his wealth took 50 years to build, the other $80 billion too like 25 years or less than half the time it took to get the first billion.

He had to create companies, invest, graduate from Columbia, start businesses, and save the excess for 50 years to create the other 99% of his wealth!

In farming, like 99% of the crop comes from just 2% of the seeds that survive. Every time you invest your money, you are sowing seeds for your future self.

Focus less on buying luxury and focus more on buying assets to pay for luxury. I even get inspired by fictional cartoon characters like Scrooge McDuck and his number one dime story.

In a book I read, they state three of their truths about money. She stated, “the Scarcity Mind- set taught me the three lessons that would eventually turn me into a millionaire:

Money is the most important thing in the world.

Money is worth sacrificing for.

Money is even worth bleeding for.

Well, until next time party people. I’m out.

![How to Invest in Real Estate: The Ultimate Beginner's Guide to Getting Started by [Turner, Brandon, Dorkin, Joshua]](https://i2.wp.com/images-na.ssl-images-amazon.com/images/I/41ZwqwL8NWL.jpg?w=474&ssl=1)